oregon tax payment deadline

By phone with credit debit or prepaid card American Express not accepted. Choose to pay directly from your bank account or by credit card.

The extended irsoregon efile deadline is oct.

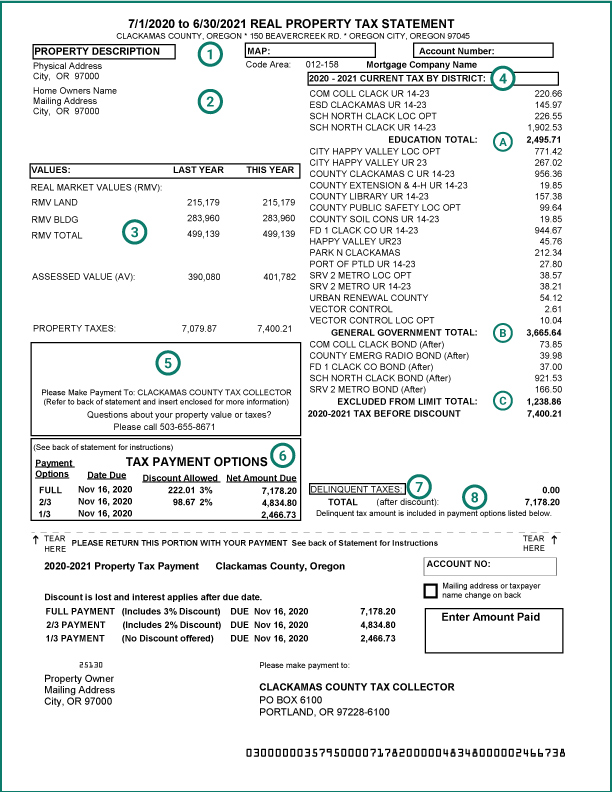

. Everything you need to file and pay your Oregon taxes. If you choose this installment schedule the second one-third payment is due on or before February 15th and the third payment is due on or before May 15. The peak time for filing was 1500 to 1559 when 1407 returns were received normally late.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Last week the IRS delayed tax filing and tax payment deadlines to July 15 without interest or penalties. The Internal Revenue Service is pushing back the tax filing deadline by a month.

503 945-8199 or 877 222-2346. 2022 second quarter individual estimated tax payments. The Oregon tax filing and tax payment deadline is April 18 2022.

The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020. The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available. 2021 individual income tax returns filed on extension.

This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension. Oregon Corporate Activity Tax payment deadline July 31 2020. If you choose this installment schedule the final one-third payment is due on or before May 15.

15 Tax collector serves warrants to enforce payments of delinquent property taxes remaining unpaid May 15. Skip to the main content of the page. 311610 30 June 30 or 60 days after the destruction whichever is later is the last day to file application for proration of taxes for property destroyed.

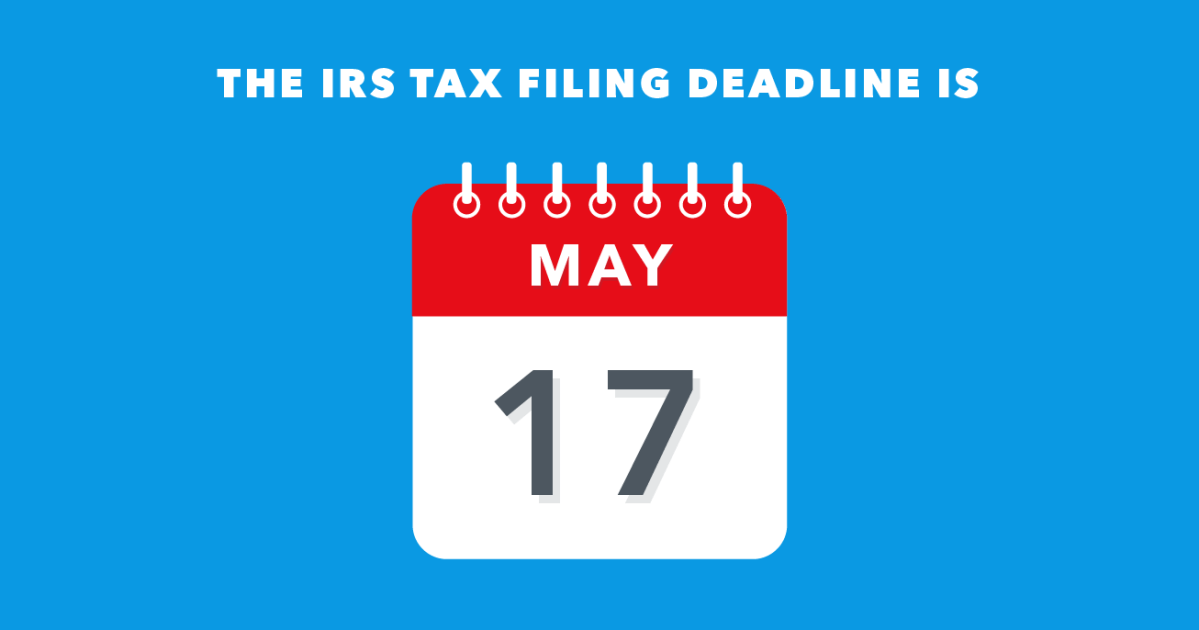

Rule 1 If the federal tax due is less than 1000 at the end of any calendar quarter the Oregon tax due must be paid by the end of the month following the end of the quarter. What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. With April 15 approaching the Oregon Department of Revenue has issued a reminder to taxpayers that the deadline for filing individual income tax returns for the 2020 tax year has been postponed to May 17 2021.

Pay the one third amount by November 15 no discount is allowed. On Wednesday March 25 Governor Kate Brown announced that tax payment deadlines and personal filing deadlines for Oregon would also be delayed until July 15 2020. 2022 fourth quarter individual estimated tax payments.

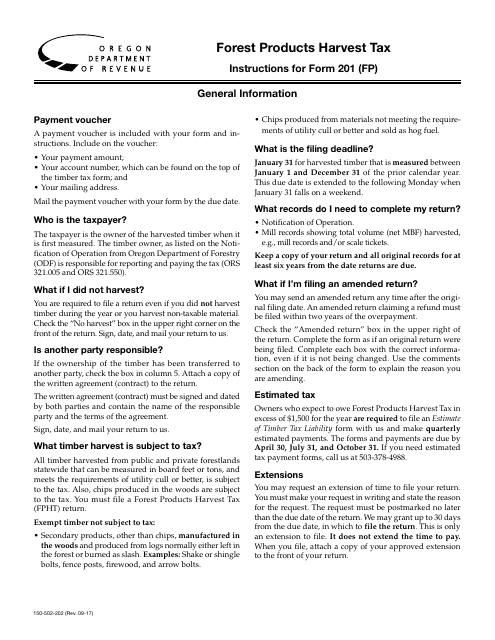

To review for the 2020 tax year if you expect a Corporate Activity Tax liability of 10000 or more then you are required to. Oregon Department of Revenue. Income taxes and payments will now be due May 17 instead of April 15 the agency and Treasury Department announced.

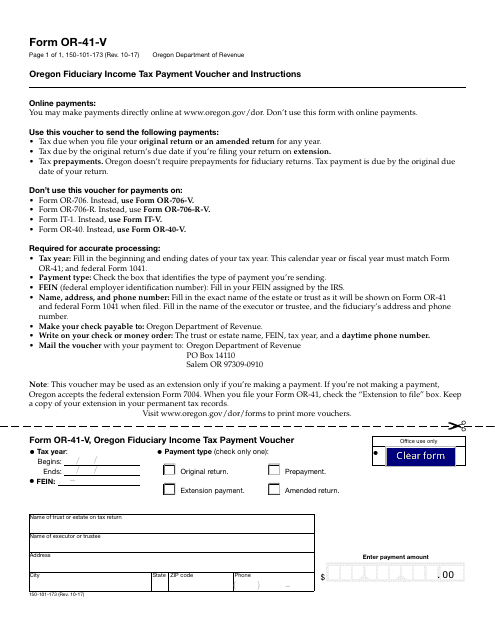

Form OR-40 OR-40-N and. Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020. Include a Form OR-40-V in the envelope with your payment.

The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. Find IRS or Federal Tax Return deadline details. Rule 2 If the federal tax liability is 50000 or less in the lookback.

Income tax deadline has been moved from April 15 to May 17. Estimated tax payments for tax year 2020 are not extended. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021.

The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is monday april 18 2022 for most taxpayers. Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. 1st quarter 2022 estimated tax payment due.

Commercial activity generally means a persons or unitary groups total amount. 2022 third quarter individual estimated tax payments. However your payment envelope must be postmarked on or before May 17 2021 to avoid penalty and interest.

Oregon Department of Revenue. Instructions for personal income and business tax tax forms payment options and tax account look up. Get Access to the Largest Online Library of Legal Forms for Any State.

The IRS and Oregon both announced the postponements last month. 1 Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly.

Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed. Mail a check or money order to. If you owe tax you can file your return any time before May 17 2021.

Taxpayers that have substantial nexus with Oregon must pay taxes on their Oregon commercial activity. Ad The Leading Online Publisher of Oregon-specific Legal Documents.

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest

Oregon Ifta Fuel Tax Requirements

E File Oregon Taxes For A Fast Tax Refund E File Com

Oregon Dept Of Revenue Expands Tax Filing Payment Extensions Ktvz

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Understanding Your Property Tax Bill Clackamas County

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Where S My Oregon State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

The Tax Deadline Is May 17 Make These Moves Before You File Forbes Advisor